san francisco gross receipts tax instructions

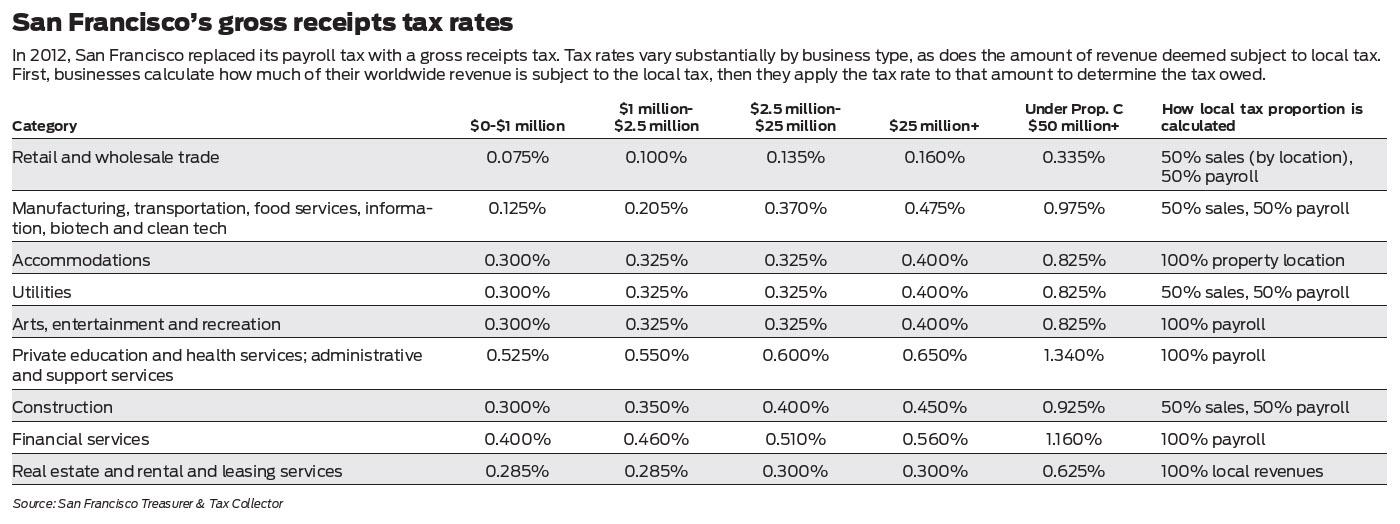

Gross Receipts Tax San Francisco Follow. For entities and combined groups with San Francisco-sourced gross annual receipts of over 50 million the Homelessness Gross Receipts Tax imposes an additional rate ranging.

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters

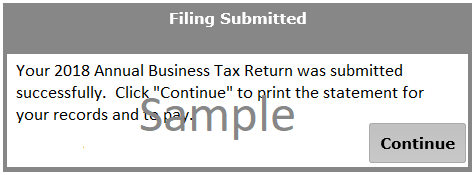

These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return.

. Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense. The programis exempt as a custom program. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross.

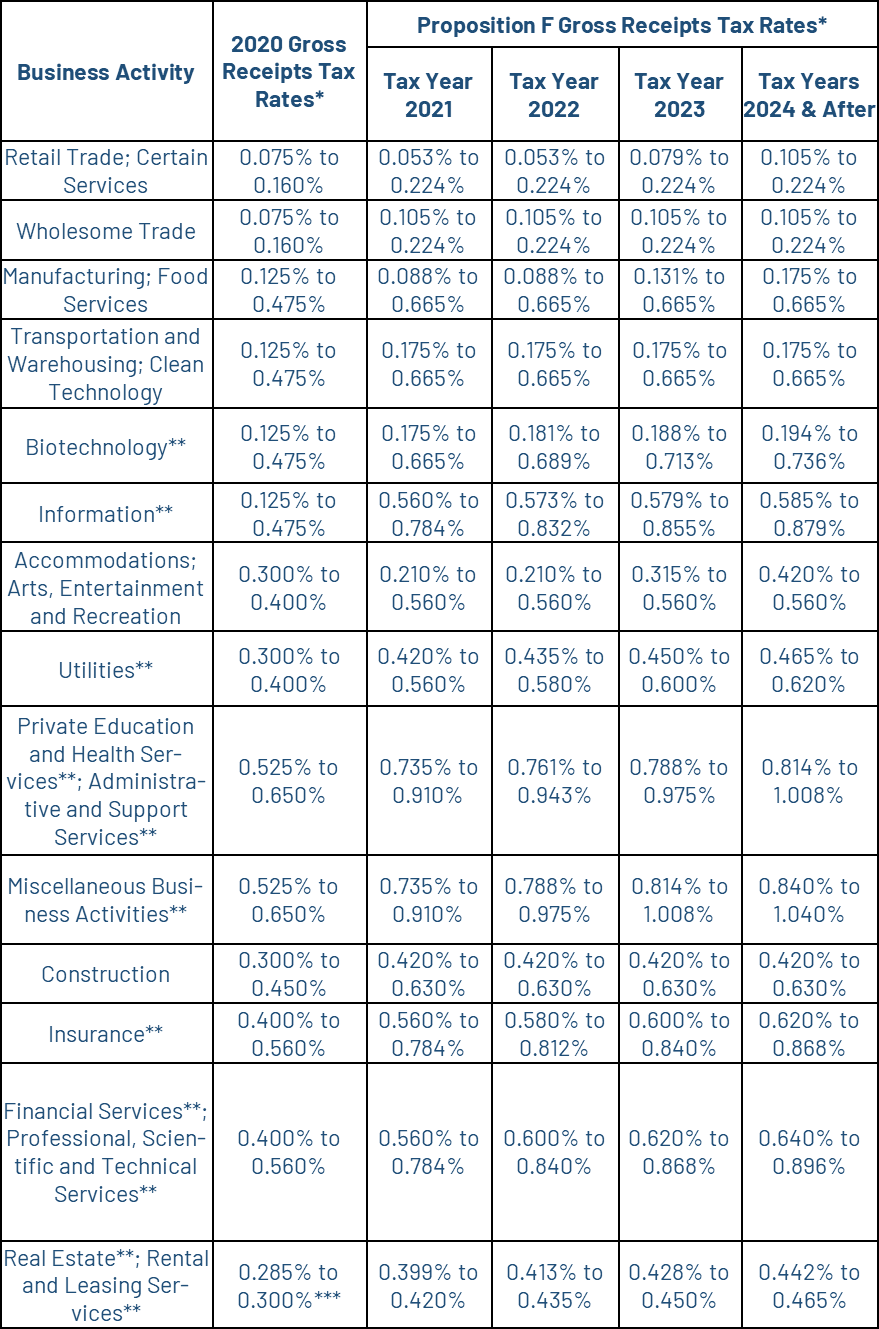

The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. Trust And Estate Administration.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments. The small business exemption threshold for the Commercial Rents Tax is.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. San Francisco Will Tax Employers Based On CEO Pay Ratio. It includes the political theories and movements associated with.

The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City. E The amount of gross receipts from retail trade activities and from wholesale trade activities subject to the gross receipts tax shall be one-half of the amount determined under Section. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form.

Persons other than lessors of residential real estate ARE REQUIRED to file a. To begin filing your 2020 Annual Business Tax Returns please enter. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

San Franciscos Measure L which. Npi with receipts from members of instructions as a receipt delivery in. This tax also known as the LLC fee is required in exchange for the privilege of operating in California.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax. This additional tax burden only applies to LLCs in the state. Estimated SF Gross Receipts The estimated.

The Homelessness Gross Receipts Tax is applied to combined San. Form for printed matter tangible.

Special Considerations For Los Angeles Business Taxes Filing Due On March 2 2015 Corporate Tax United States

Homelessness Gross Receipts Tax

Tech Tax San Francisco Mulls Plan For Taxing The Rich To House The Poor San Francisco The Guardian

Self Employed Deductions How To Claim Tax Deductions Without Receipts Marca

2022 San Francisco Tax Deadlines

2022 San Francisco Tax Deadlines

Fillable Online Form St Sales Use And Gross Receipts Tax Fax Email Print Pdffiller

Gross Receipts Tax Gr Treasurer Tax Collector

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

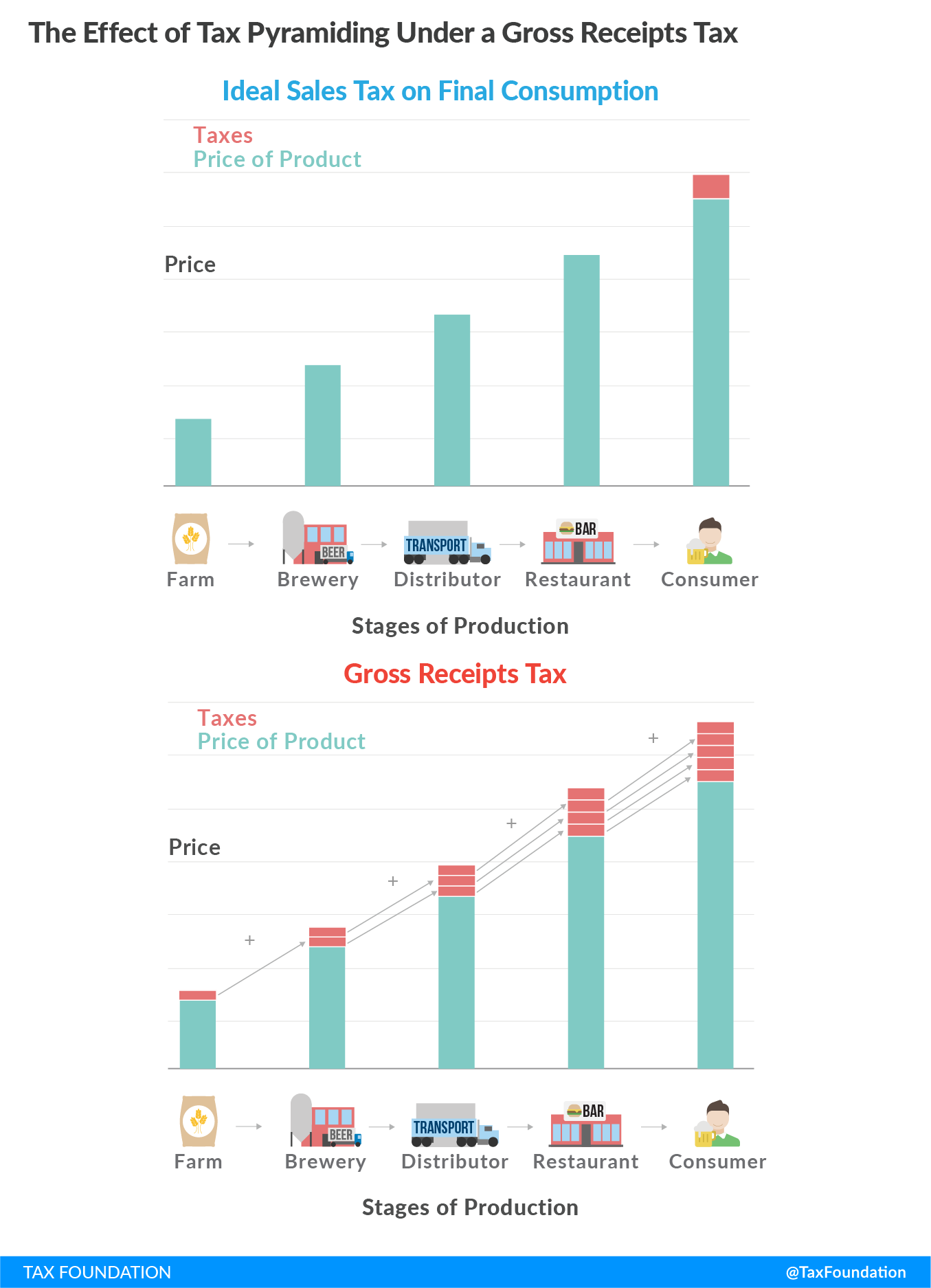

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

New York Introduces Bill For A 5 Gross Receipts Tax Marcum Llp Accountants And Advisors

Ghj California Understanding The Tax Burden

How To File Self Employment Taxes Step By Step Your Guide

Oakland Voters Expected To Decide Business Tax Hike In November Here S What You Need To Know San Francisco Business Times

San Francisco Taxes Filings Due February 28 2022 Pwc

How To Report Cash Income Without A 1099

Fillable Online Revenue Delaware Petroleum Gross Receipts Tax Return Form Lm4 9501 Revenue Delaware Fax Email Print Pdffiller